FSA

Flex Spending Accounts (FSA)

*Vendor will be changing to HSA Bank Effective January 1st 2024.*

- For those of you currently with WEX, you will use them until your run out period for claims which is March 31, 2024.

- New contributions will be sent to HSA Bank for 2024.

|

Medical FSA

|

Dependent Care FSA |

|

Why should I choose a medical care FSA?

|

Why should I choose a dependent care FSA? |

|

|

Medical and Dependent Care FSAs

To access your personal WEX account login at wexhealth.com

*March 31, 2024 - deadline to submit claims for 2023

Contribution Limits & IRS Regulations

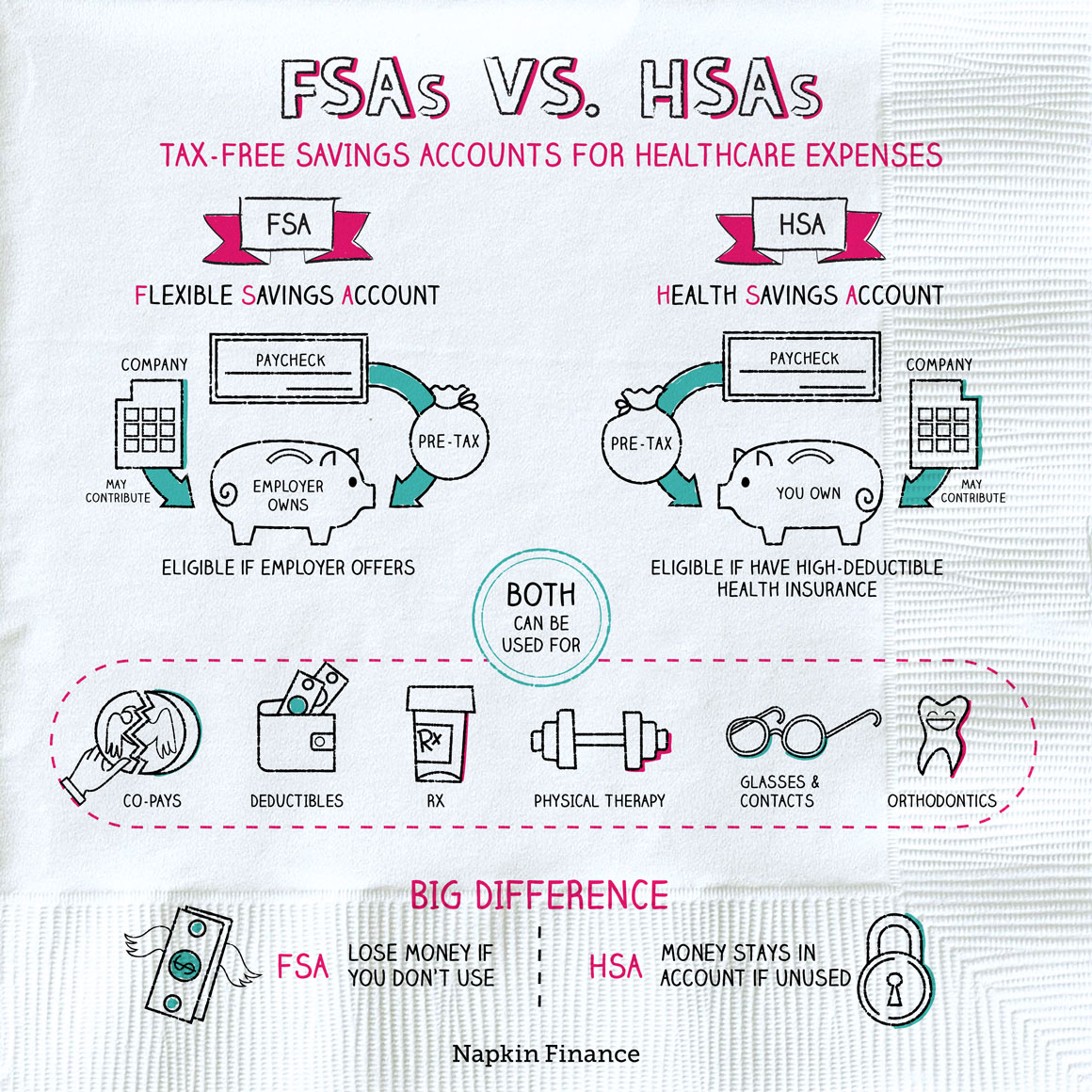

The IRS sets the maximum dollar amount you can elect and contribute to a medical flexible spending account (medical FSA) and dependent care FSA.

The 2023 FSA annual contribution limit is:

What Can You Expense?

There are thousands of eligible procedures, items and expenses based on your plan. View WEX's interactive list of eligible FSA & HSA expenses at https://www.wexinc.com/insights/benefits-toolkit/eligible-expenses/

Create an account and shop with your FSA card.

You can also find at the bottom of the FSA store Helpful Tools like:

- Discover Eligibility Lists

- Grow FSA Learning Center

- FSA Calculator