HSA

2023 vs. 2024 HSA Contribution Limits

_____________________________________________________________

HSA Deduction Change Request

To change your HSA deduction outside of open enrollment complete the following K-12 Form:

If you have any questions contact:

Laura Champagne at [email protected]

_____________________________________________________________

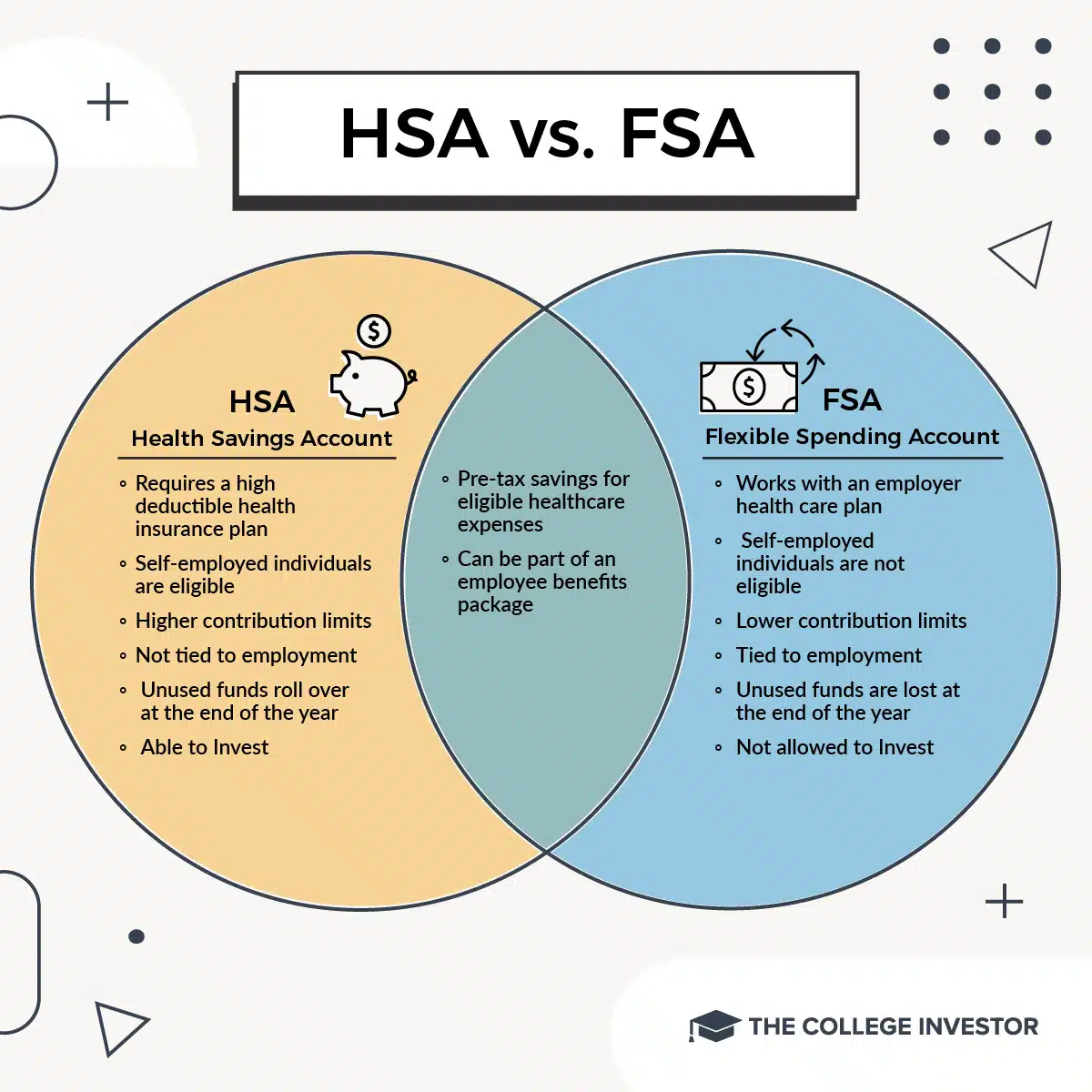

Only an HSA Delivers a Triple-Tax Advantage

To contribute to an HSA, the IRS requires account holders to:

-

- Not be enrolled in Medicare

- Not be claimed as a dependent on someone else's tax return, and

- Be covered by a federally defined high-deductible health insurance plan (HDHP) on the first day of the month

Eligible HSA Expenses:

There are thousands of eligible procedures, items and expenses based on your plan. View The HSA Store's interactive list of eligible HSA & FSA expenses at https://hsastore.com/

HSA and Medicare what you should know:

Contacts:

*NEW for 2024

HSA Bank

800-357-6246

Prior to 2024...

First Merchants Bank

866-833-0050 firstmerchants.com